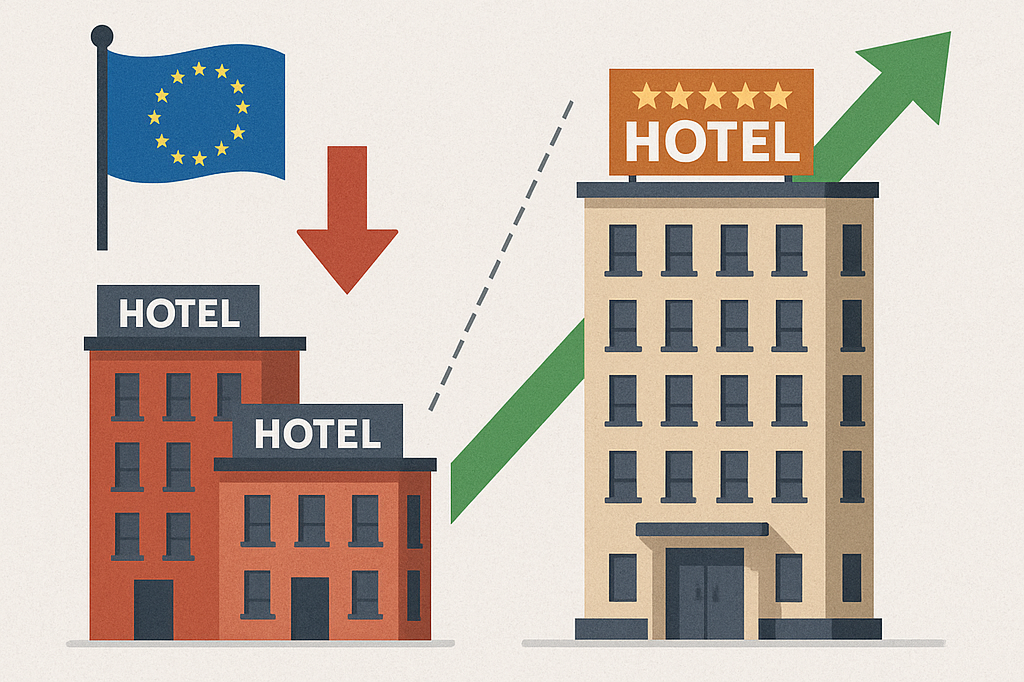

How new EU rules could disadvantage small hotels while strengthening large, well-resourced players.

Executive Summary

The European Union has introduced the Empowering Consumers for the Green Transition Directive (EmpCo) and proposed a Green Claims Directive to curb misleading environmental claims. While these regulations aim to increase trust and transparency, new evidence from over 82,000 European hotels reveals that access to sustainability certification—the main tool for proving green claims—is uneven. Certification is concentrated among hotel chains, larger properties, and high-end hotels, leaving small, independent establishments at risk of exclusion. This blog explores how such legislation may unintentionally legitimise inequities in the hospitality sector, why certification uptake is highly uneven, and what policies or industry actions are needed to prevent well-intentioned regulation from creating new barriers.

Introduction and Context

Consumer trust in sustainability claims is at a breaking point. A 2020 European Commission review found that more than half of environmental claims were vague or misleading, and 40% lacked evidence. In response, the EU has acted through two directives: the Empowering Consumers for the Green Transition Directive (adopted in 2024) and the stalled but influential Green Claims Directive. Both aim to ensure that environmental claims are transparent, substantiated, and verifiable.

For the tourism and hospitality sector, these regulations matter enormously. With over 300 certification schemes in Europe, the new directives make third-party verification the baseline requirement for marketing sustainability. Certification, once a voluntary and largely symbolic practice, becomes central to market access. Yet, certification is not equally attainable. Costs, administrative burdens, and uneven institutional support mean that larger, wealthier, and chain-affiliated hotels are more likely to secure certification, while small and independent businesses risk being left behind.

This blog introduces findings from a study of 82,301 hotels across Europe, analysing which establishments are most likely to be certified and how the EU’s anti-greenwashing legislation could reshape the competitive landscape. The central argument is that without deliberate support measures, regulation designed to prevent greenwashing could inadvertently deepen inequities in the hospitality sector.

Theoretical or Conceptual Framework

Sustainability certification in tourism has long been promoted as a tool for transparency, accountability, and market differentiation. In practice, it is shaped by several theoretical perspectives:

- Resource-based view & economies of scale: Larger organisations can spread certification costs across many units, making adoption more affordable compared to small, independent hotels.

- Institutional theory: Hotels respond to regulatory, normative, and mimetic pressures to adopt certification, especially when legislation or industry norms push adoption.

- Signalling theory: Certification acts as a market signal of credibility, reducing information asymmetries between hotels and consumers or corporate buyers.

- Real options theory: Firms make strategic decisions under uncertainty—choosing to wait, invest partially, grow, or withdraw—depending on how they assess risks and benefits.

The EU’s EmpCo and Green Claims Directives alter the calculus of certification by raising verification standards and creating new risks for non-compliance. Certification, previously voluntary and often symbolic, is becoming a mandatory prerequisite for making sustainability claims. The question is whether this shift creates fair competition—or entrenches the advantages of already powerful players.

Analysis and Development

Who Gets Certified?

Analysis of 82,301 hotels across 27 European countries shows that certification is not evenly distributed. Only 9.3% of hotels were certified in 2024, with adoption strongly linked to:

- Membership of a hotel chain (certification odds 7–9 times higher than independents).

- Hotel category, with 4–5 star hotels far more likely to be certified.

- Larger size, using booking reviews as a proxy for capacity.

- Medium to high customer satisfaction ratings.

- Location in countries with medium to high tourism employment shares.

Why Does Inequity Matter?

Hotels with fewer resources—often independent, small, or budget properties—are least likely to certify, despite often making significant sustainability efforts. Under EmpCo, these hotels may no longer be able to communicate those efforts unless verified, silencing authentic sustainability practices while amplifying the voices of resource-rich chains. This risks reinforcing structural inequities already present in European tourism.

Strategic Responses Under Uncertainty

Using real options theory, the study identified four strategic responses:

- Wait and see: Many hotels are delaying decisions until the Green Claims Directive is clarified.

- Partial investment: Some are piloting certification in select properties.

- Growth: Large chains see certification as a competitive advantage and are scaling adoption.

- Withdrawal: Smaller hotels may stop making green claims altogether, to avoid compliance risks.

Case Examples

- In France, legislation requiring certification by 2026 has boosted uptake, supported by subsidies covering up to 80% of costs.

- In contrast, Booking.com discontinued its self-reported “Travel Sustainable” programme in 2024, shifting entirely to verified certification, which disadvantaged uncertified small hotels reliant on the platform for visibility.

Discussion

The data confirms that certification is not a level playing field. While well-intentioned, EU anti-greenwashing laws may inadvertently create trade barriers within tourism, favouring large, chain-affiliated, and high-end hotels. This raises both opportunities and risks.

Opportunities exist for certified hotels to strengthen market credibility, attract corporate clients, and gain early mover advantage. Certification schemes and online travel agencies are already aligning with legislation, pushing hotels toward compliance. Yet the risks are equally clear: small and independent hotels may withdraw from making sustainability claims, reducing diversity and authenticity in the market. Without targeted support—subsidies, simplified procedures, or tailored SME frameworks—the legislation could legitimise inequity in sustainability communication.

Conclusions and Recommendations

This study highlights three key conclusions:

- Certification uptake is concentrated among large, chain-affiliated, and higher-end hotels, leaving smaller players behind.

- EU anti-greenwashing legislation, while tackling misleading claims, risks reinforcing inequities by making certification a de facto market entry requirement.

- Strategic hotel responses range from growth to withdrawal, depending on size, resources, and risk appetite.

Recommendations:

- For hotels: Audit existing claims, prepare supporting data, and explore accessible certification options.

- For policymakers: Provide subsidies, technical support, and proportionate requirements for SMEs to avoid exclusion.

- For certification bodies: Adapt criteria and pricing to serve small businesses and diverse markets.

- For online travel agents and distributors: Ensure sustainability filters do not disproportionately disadvantage small suppliers.

Only by embedding equity in both design and enforcement can legislation achieve its goal of credible, transparent sustainability communication without unintended harm.

References

European Commission (2020, 2024, 2025); Booking.com (2021, 2025); Font et al. (2025); Guix et al. (2025); McDermott (2013); Nadvi (2008); Bernard & Nicolau (2022); Bianco et al. (2023). [Adapt APA style with links as required]

About the Author

Xavier Font is Professor of Sustainability Marketing at the University of Surrey and Editor of the Journal of Sustainable Tourism. He has advised international organisations and businesses on sustainable tourism certification and communication for over 20 years. LinkedIn Profile.